How to Make a Mobile Wallet App: Development Guide

How often do you make an online payment? Do you find it comfortable? 82% of Americans already use digital payments (both browser-based and in-app transactions), exceeding 78% for 2021 and a tendency to reach 100% in coming years.

Mobile payments are the future, and there is a strong tendency for people to move to a cashless world. To keep your business competitive, it should definitely have an online payment system; otherwise, it will be a drawback for the customer to interact with your brand. If your business model doesn’t require online payments, you can still benefit from the technology by developing a mobile wallet app stuffed with practical features.

The following article will reveal the critical aspects of mobile wallet app development.

Here’s what you will learn in the article:

- Reasons to invest in mobile wallet app development

- Most popular mobile wallet solutions

- Key benefits that you can get from wallet apps

- Technical aspects of mobile wallet app development

- Technologies & SDKs used during development

- Basic & advanced features

- Services and processes of app development

- How to create a digital wallet in 7 steps

Why Invest in Mobile Wallet App Development in 2024

So, what is a mobile wallet?

Mobile wallets are digital wallets that store payment and card information on mobile devices. They offer an innovative way for online payments. Users don’t need to have credit cards to make payments. All they need is a smartphone connected to the internet.

Not sure why it’s worth creating a digital wallet app in 2024?

The below statistics will dispel any doubts:

- By 2024, the number of mobile payments users approximately 2.8 billion worldwide.

- By 2024, the global mobile payment market is predicted to be estimated at USD 2.98 billion in 2023 to USD 18.84 Trillion by 2030, exhibiting a CAGR of 30.1% during the forecast period.

- The number of mobile wallets will reach 4.8 billion by 2025 and will count for half of all eCommerce payments.

As you can see, there is no doubt that the number of mobile payments will only grow in the following years. There are a lot of successful payment mobile wallets on the market, and we’ll review the most outstanding ones in the next chapter.

Examples of the Most Popular Wallet Apps

As a part of learning how to make a mobile wallet app, let’s find inspiration by looking at some of the best mobile wallet apps on the market.

- Google Pay

Google allows its mobile operating system, Android users, to leave their wallets at home and pay for purchases with mobile phones. This digital wallet allows connecting different cards, such as MasterCard, Visa, American Express, and others worldwide. The app is available across different operating systems, including Android and iOS. Today, there are over 100 million active users of Google Pay.

- Apple Wallet

This digital wallet app is created by the famous Apple company. The solution allows to add different types of payment cards and make online and mobile payments through the Apple Pay payment system. This application is available only for the Apple ecosystem – iOS, watchOS, and macOS. Already in 2024 Apple Pay had 507 million users.

- PayPal One Touch

PayPal is leading the game with its payment solutions counting over 430 million worldwide. The One-Touch application allows making online payments and payments in offline locations using a smartphone. It’s available for both Android and iOS.

- AliPay

If you are looking for a giant in mobile payment apps, look no further. Alipay is the largest payment app globally created by the Alibaba Group. There are over a billion users worldwide that use this system every day.

Industries that Benefit from Mobile Wallet Application Development

Mobile wallet development conceals the potential to change how industries operate. Explore the list below to find out how you can benefit from it.

Retail & eCommerce

This year, global ecommerce sales will exceed $5 trillion, with predictions to surpass $7 trillion by 2025.

Digital wallet apps in retail can store information about all purchases made by a customer and help them manage payments, bonuses, loyalty cards, coupons, etc.

Healthcare

The healthcare services industry can also take advantage of mobile wallet apps by allowing them to pay bills for medical services.

Telecommunication

Mobile wallet apps are quite popular among telecommunication companies. You can pay a bill, recharge your phone number or even a third-part number, receive and send payments. As a result, users can recharge their accounts right inside telecommunication providers’ applications.

Banking Financial Services and Insurance (BFSI)

Banking and financial institutions benefit from mobile wallet apps the most. Such applications store debit and credit card information and allow users to make secure mobile payments right in the app.

Transportation & Logistics

Businesses operating in transportation and logistics can allow their clients to pay for services right through apps. For example, Uber allows users online payments. You can integrate various payment gateways to make the app more convenient for users.

Food & Grocery

The food and grocery industry can also benefit from mobile wallet app development. Booking and paying for a restaurant, ordering food, and online purchasing movie tickets are just a few examples of how businesses from these spheres can use mobile wallets.

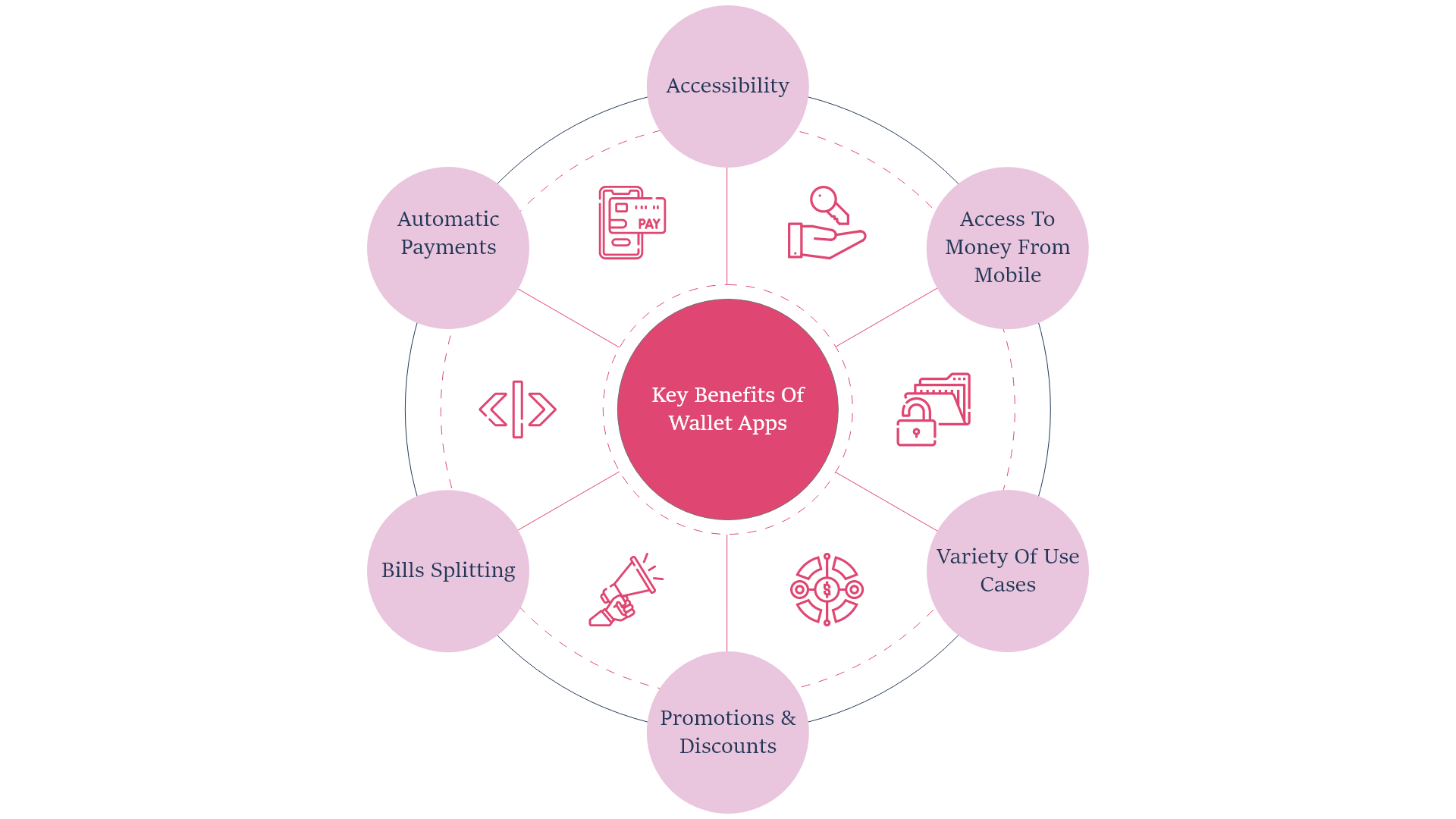

Key Benefits that Mobile Wallet Applications Can Bring

Why should you develop a mobile wallet app?

Such applications can deliver many benefits to businesses in every industry.

- Accessibility

Mobile wallets allow making day-to-day transactions without carrying around physical cards. All they need is an app on their smartphone and a user ID.

- Access to money from mobile

Users can start making mobile payments in no time. They need to connect their cards to the digital wallet and make payments with smartphones.

- Variety of use cases

Mobile wallets can be used for a range of uses. Users can pay for purchases, buy tickets, pay for online services, etc.

- Bills splitting

Depending on where you are using the wallet app, you can add the functionality allowing users to split the bill and send a link to users who needs to pay them money.

- Automatic payments

You can add the ability to set up automatic payments within your app so users won’t forget about them because of their hectic everyday life.

- Promotions & discounts

Digital wallets usually offer different promotions and discounts. You can reward users for buying at partners’ locations, making a certain number of monthly payments, etc.

How to Create a Digital Wallet: Technical Aspects

It’s time to explore how to make a mobile wallet app from a technical point of view, starting with the key types of mobile e-wallet apps.

Types of Mobile Wallet Apps

Generally speaking, wallet apps differ based on the type of payment processing.

Explore some of the most popular types of digital wallets:

- Wallets that use mobile communication providers to send and receive money

- Wallets that write off funds from banking accounts, cards, or mobile services using SMS messages with a short code

- Wallets that make mobile web payments

- Wallets that use near field communication (NFC) built into smartphones for contactless interactions with payment terminals.

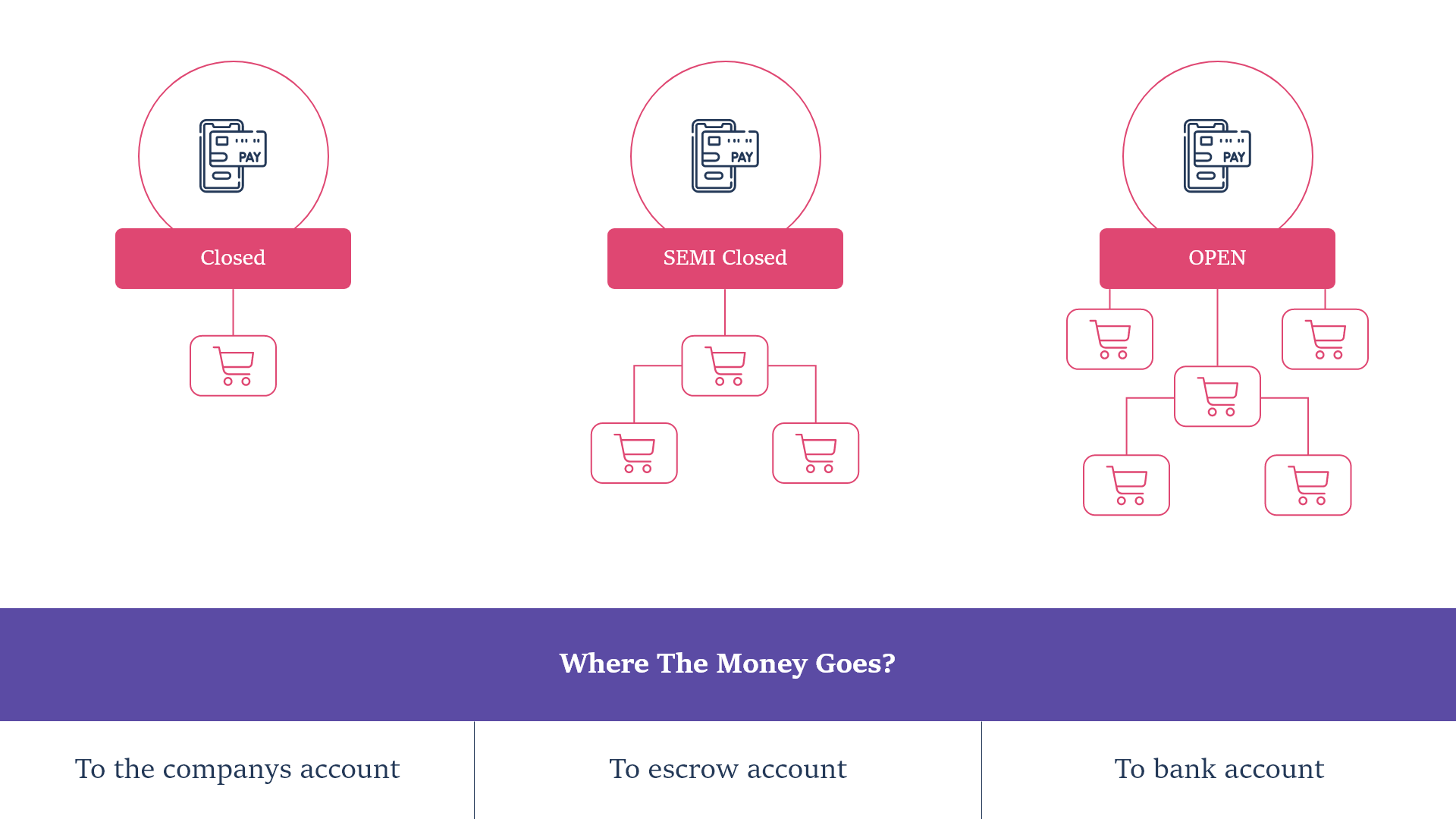

According to another definition, mobile wallet apps can be divided into three following types:

- Closed – mobile wallets that can be used with only one merchant.

- Semi-closed – wallets that can be used with many supported merchants.

- Open – mobile wallets that can be used with any merchants and provide access to multiple bank accounts.

Depending on the development purpose, you might create an app that will combine a few of the technologies, allowing both mobile and NFC payments.

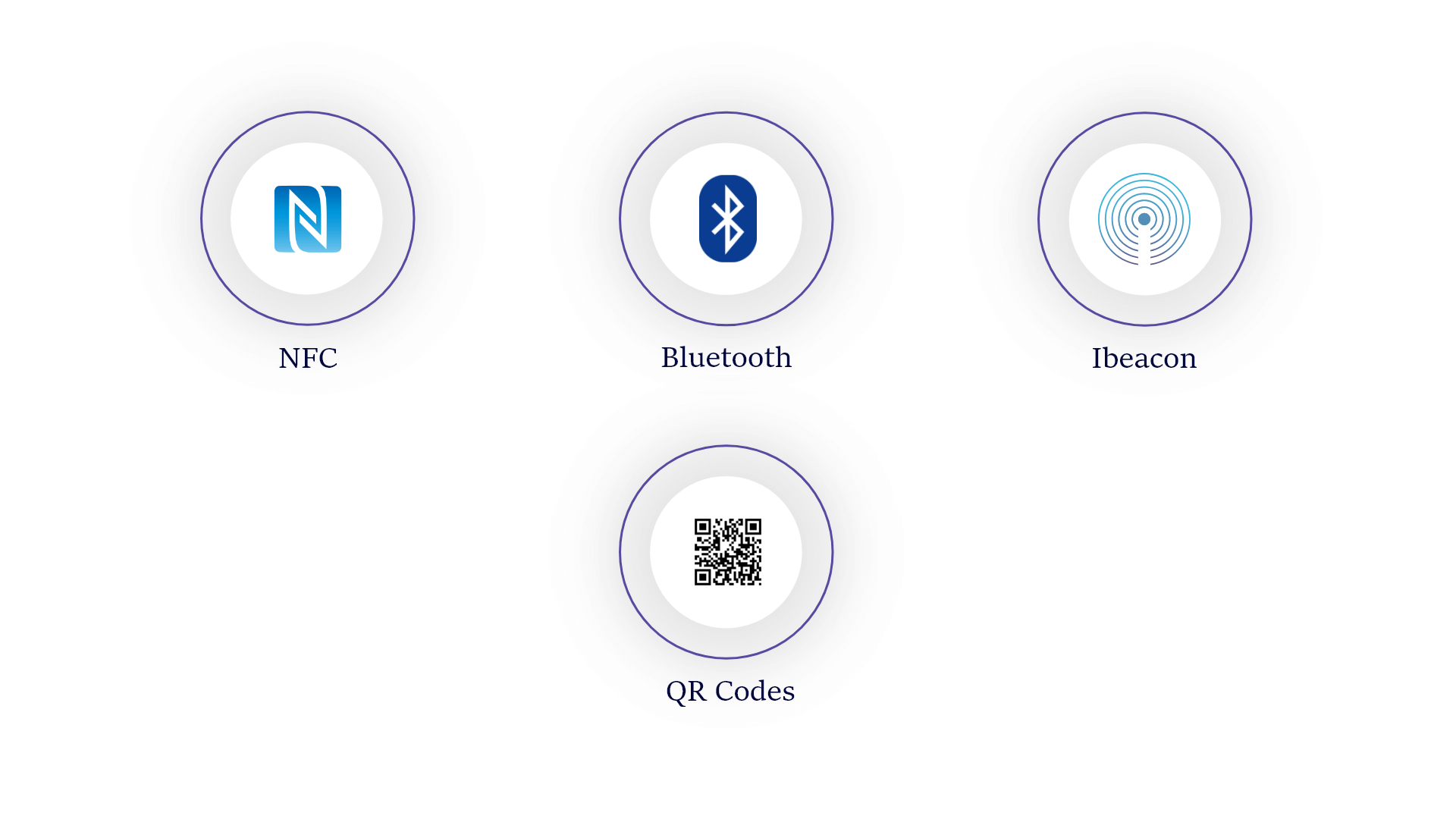

Data Transfer Technologies Used in Wallet App Development

Without understanding what technology is used in similar applications, it is impossible to build an app.

Usually, mobile wallet apps use one or a combination of the following data transfer technologies:

- NFC

NFC or Near Field Communication Protocol enables contactless money transfer between smartphones equipped with NFC chips and a transmitter in a POS device. NFC connects to the transmitter in a record time, less than one-tenth of a second.

NFC relies on the card emulation technique. This protocol allows storing card details in a digital form inside a mobile wallet application. During payment, the protocol transmits data to the POS terminal automatically.

- Bluetooth and iBeacon technologies

iBeacon is a technology that allows for data transfer without an internet connection. Since all smartphones today are equipped with Bluetooth, they are all compatible with iBeacon.

After users activate Bluetooth, it communicates with an external BLE transmitter, also called a beacon. POS terminal receives all the necessary data stored in a mobile wallet and transfers money.

Another use case of iBeacon technology is offering personalized special offers and discounts when users come within the range of a beacon’s activity.

- QR codes

This type of payment is also popular. Users need to point their smartphone’s camera to a QR code, and a mobile wallet app will transmit money. This payment method usually requires a password or other user authentication technique for action confirmation.

Modern smartphones are equipped with all the necessary chips and technologies to implement mobile wallets. The camera scans QR codes, Bluetooth enables iBeacon technology, face recognition, or fingerprint scanner is used for user authentication.

What about security?

Security Technologies Used in Mobile Wallet App Development

When it comes to mobile payments, users have one concern – security.

Around 40% of US consumers don’t use mobile payments because of security concerns. If you want to create an online wallet that won’t raise concerns among users, you need to use security technologies for data encryption.

Here is a list of some security technologies that you can use during mobile wallet app development:

- Point-to-point encryption (P2PE)

P2PE is one of the most secure data protection methods for mobile wallet applications. The encryption process starts as soon as the user swipes the smartphone over a POS terminal. The encryption goes on when the funds are in transit and lasts till authorization.

- Tokenization

Tokenization is a data encryption system that encrypts card information by turning it into a token – a string of random symbols.

- Password

Passwords are old but working technology. Allow users to protect their data with a password and include a rejection feature for too short and simple passwords. The use of password protection makes a mobile wallet application more secure and offers an additional layer of protection to the data stored there.

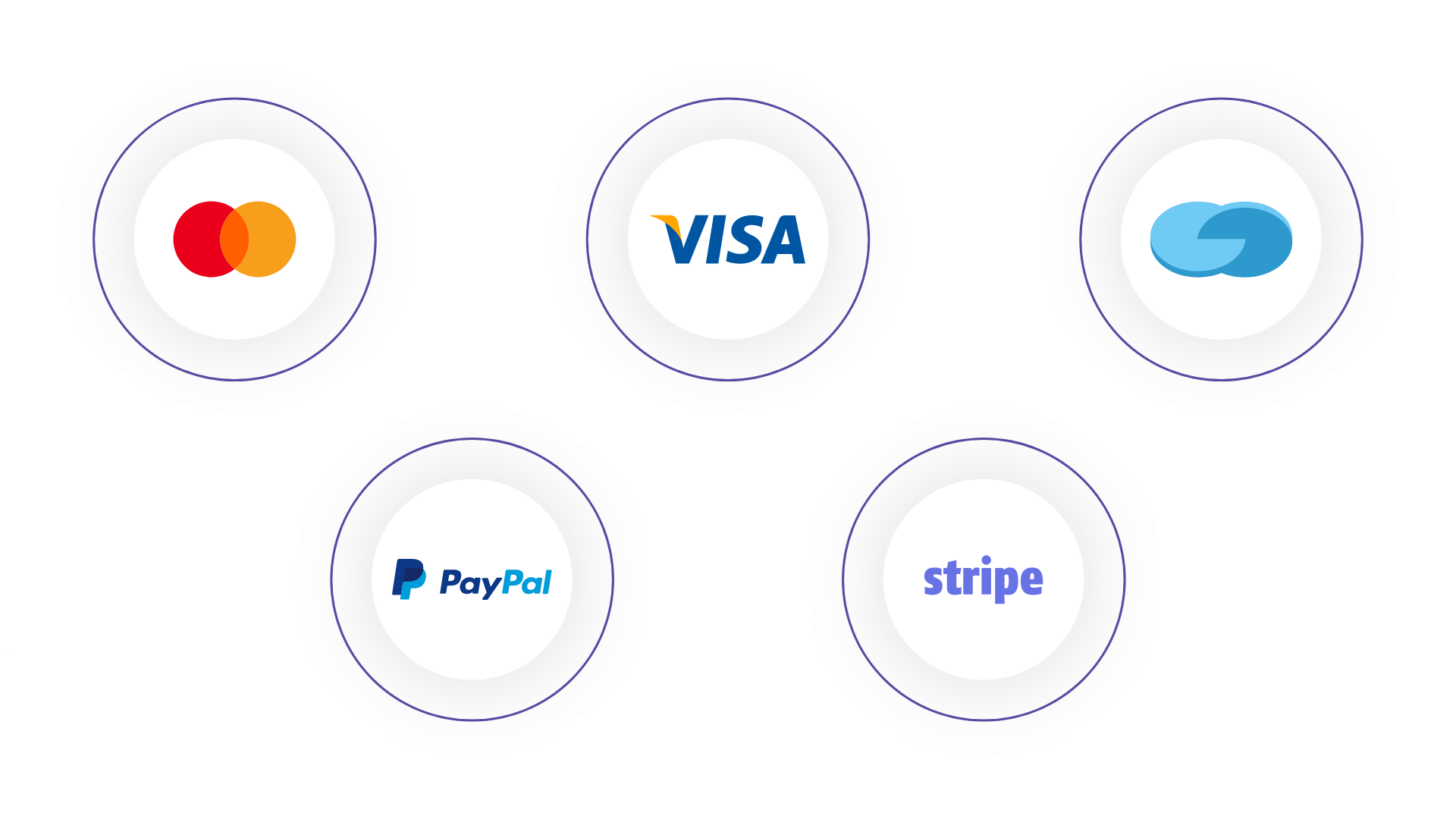

How to Make a Mobile Wallet App: SDKs

As a part of development, let’s review some of the SDKs (Software Development Kits) that you can use to streamline the development project. There are a number of payment SDKs that you can integrate into your mobile wallet. Below, we review some of the most popular ones.

- Mastercard Mobile Payment SDK

If you want to build a mobile wallet app that will support the use of the Mastercard payment system, consider adding Mastercard Mobile Payment SDK to provide support for both online and in-store transactions.

- Braintree SDK

Braintree is a popular SDK for mobile payment wallets that you can use with no additional fees. It’s a great choice for new and aspiring businesses.

- PayPal Mobile SDKs

PayPal provides SDKs to create digital wallets, such as PayPal Native Checkout SDK.

- QuickPay Mobile SDKs

QuickPay is a popular payment system from the UK that offers a few SDKs to process online and in-store transactions. The SDKs are available for both Android and iOS. Please note that you will need to pay a fee for using these SDKs.

- Stripe SDK

Stripe is one of the most popular payment gateways, especially in the eCommerce industry. It provides an SDK that you can integrate with a number of features.

- Visa SDK

Visa is also one of the payment system providers whose services are available worldwide. You might want to consider adding its support to your mobile wallet to make it available for a more considerable number of users.

These are just a few SDKs that you can use for your wallet app. Before you decide and start the development process, study the local laws and regulations. For example, in some countries, you can’t use Braintree, while in others, you can’t use PayPal.

Basic & Advanced Features of Mobile Wallet Apps

Don’t skip this section if you’re interested in creating a digital wallet. It provides examples of basic and advanced functionality that you might need to include in your application.

Let’s start with the basic features of any mobile wallet.

- User registration – registration of a user within your application with different authentication methods, such as mobile phone, email address, social media, etc.

- Push notifications – a valuable feature to notify users about successful and declined payments.

- Banking account authorization – the ability for users to connect their payment cards to your wallet application.

- Balance checking – a feature that allows users to check their account balance right from the mobile wallet.

- Transactions – the ability to work with transaction operations (sending and receiving money).

- Bills payment – a feature that allows paying different types of bills.

Aside from basic features, you might also want to consider adding some advanced functionality:

- Loyalty cards – the ability to use loyalty cards during shopping or transferring money.

- Gift cards – a feature that allows adding gift cards and using them to pay for purchases.

- Exclusive offers – notifications about special offers provided by you or your partners.

During the development of the first version of your application, you might want to include only basic functionality. This approach will allow you to validate your app idea without losing money. Advanced features might be added with further iterations.

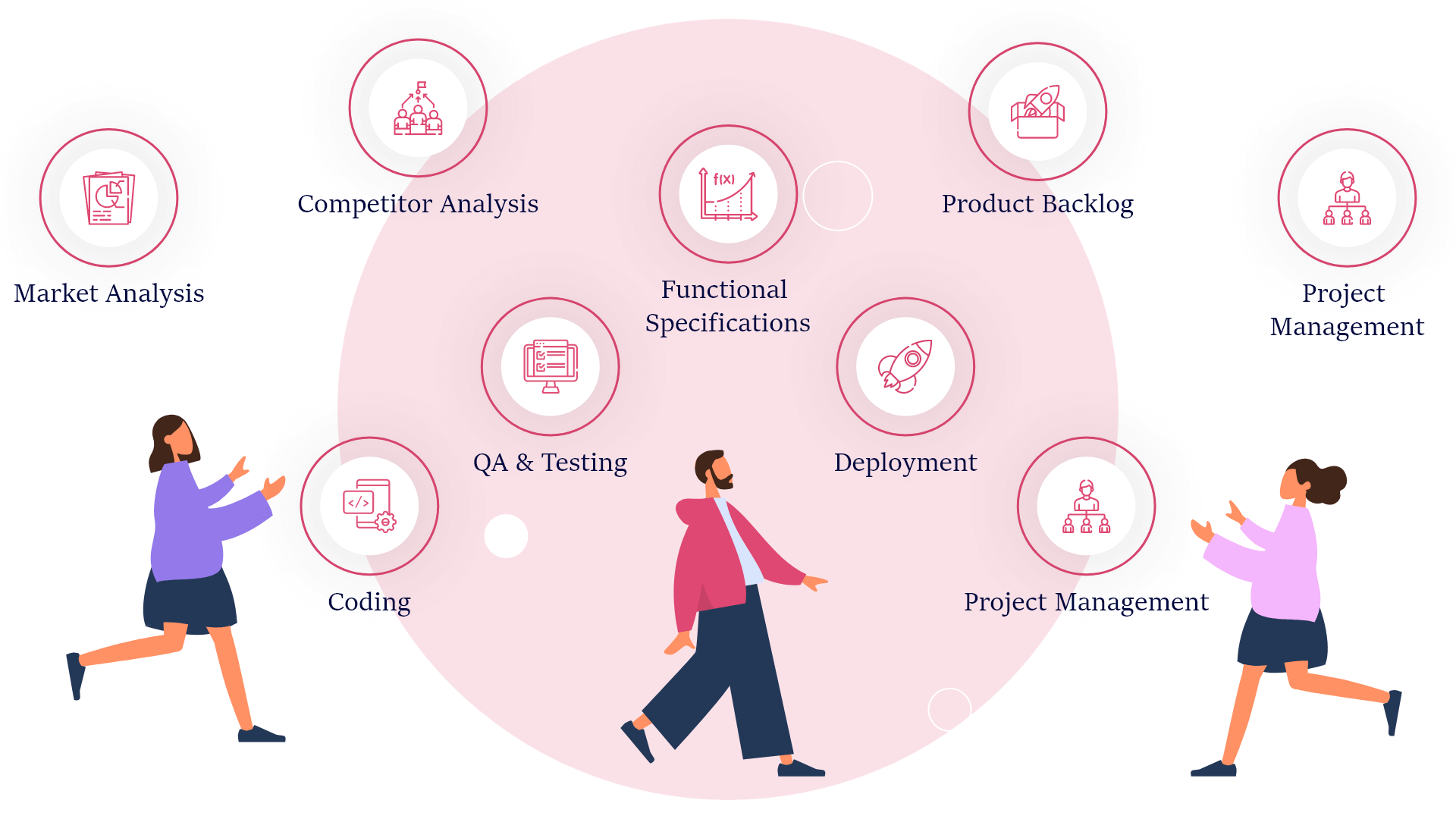

Mobile Wallet App Development: Services & Processes

The development of wallets for mobile devices is a process comprising different steps. Usually, development is divided into discovery and development stages.

1. Discovery Stage

The discovery stage is an essential part of app development. During this process, companies identify their business needs, define technical requirements and match them with technologies available on the market.

You cannot skip the discovery stage if you want to create an app with a chance for success.

At the end of this stage, you will have the following documents on your hands:

- Market analysis

- Competitor analysis

- Functional specifications

- Product backlog

The lion’s share of the discovery stage is dedicated to UX and UI design. The deliverables of this step include UX wireframes, UI mockups, branding elements, illustrations, animations, etc. During the wallet app development, you will need to identify how users will interact with your solutions and what it will look like for the end-users.

2. Development Stage

During the development stage, the coding itself happens. Developers create the code base of your application, integrate it with third-party solutions, and implement custom features.

The development stage is traditionally divided into several phrases:

- Coding – code base creation, integration with SDKs, APIs, etc.

- QA & Testing – thorough application testing to identify bugs that might interfere with the app’s use.

- Deployment – release of the developed app to the market.

- Ongoing development & Support – working on further app iterations, updating the app with new features and platform support.

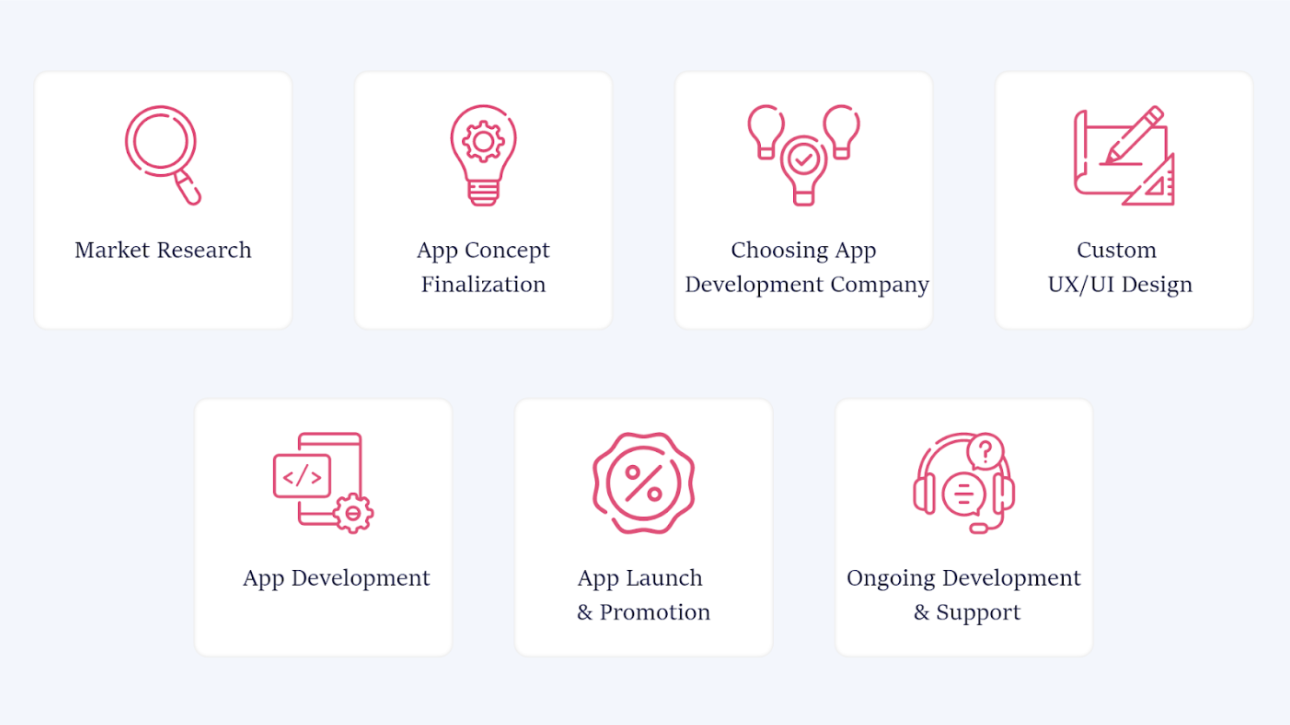

How to Make a Mobile Wallet App: Step-by-Step Guide

The development process of a mobile wallet starts long before coding. The project implementation is a complicated process comprising multiple stages, each having its crucial role in the whole process.

1. Market Research

App development usually starts with market research and competitor analysis. During this stage, you need to decide for what industry you will develop an app, who your target audience is, and who your competitors are.

Market research will help you conceptualize your application and find your value proposition.

2. App Concept Finalization

This stage is crucial for the future of your application. You need to finalize the concept of your future apps. In simple words, you need to decide on the USP (Unique Selling Proposition) and how to set your app apart from the existing competitors.

3. Choosing App Development Company

If you don’t have the necessary technical knowledge, you will need to find a development company that will create a wallet for you. Here are a few tips on how to choose a company that will become your reliable technical partner:

- Start the search online on Clutch, ITFirms, Manifest, etc.

- Check portfolio and customer reviews

- Conduct interviews with vendors

- Ask about relevant experience and similar projects

During the screening process, some aspects can influence future cooperation, such as the level of English knowledge, differences in time zones, cultures, etc.

4. Custom UX/UI Design

The interface creates the first impression of a mobile page. What users see first when they open a new app decides whether they will use it or abandon it right away. Thus, you need to address this part of all development with an eye for detail. The user interface should be feature-rich, user-friendly, and attractive.

5. Mobile Wallet App Development

Developers then turn your UX wireframes and UI mockups into a working application and implement all the necessary features.

Remember that mobile wallet applications should be created with scalability and security in mind.

6. App Launch & Promotion

After you launch the app to the market, it’s time to think about its promotion. In most cases, marketing strategy creation starts long before the app is released to the end-users.

Today, a comprehensive marketing strategy includes several parts, such as SMM, content marketing, paid ads, etc.

7. Ongoing Development & Support

The development process doesn’t stop at the previous stage. If you create an app with a long-term outlook, you will need to continue working on it.

After getting the first user feedback, you might want to add some functionality, improve existing features, and plan for further updates. The process of app development is ongoing.

How to Create a Digital Wallet: Sum-Up

Mobile wallet application development is not a simple process. It consists of numerous stages that gradually take you from an app idea to the first working version.

The current market state indicates that mobile payments will grow across all industries. Today is the best time to act on the idea you have to get business benefits tomorrow.

How to Make a Mobile Wallet App, Mobile Wallet App Development, Digital Wallet, Foldable Smartphones, Social Media App Development, Build an AI App, Language Learning, Uber App Features, NFT Marketplace, Lifestyle Trackers, AR Apps, Mobile App, App Design Cost, Development Team, IoT app development, Wearable Apps, Create a Restaurant App, Multi Screen Apps, Interview, Chatbot Development, Ecommerce How to create a banking app

Do You Want To Create a Mobile Wallet App?

Dive into the world of mobile payment solutions with your own mobile wallet app

Our Expertise Covers:

✅ Secure payment gateway integration

✅ Multi-platform compatibility and accessibility

✅ User-friendly interface and transaction history tracking

Table of contents

FAQ

The market of mobile payments is projected to grow at a rapid pace.

In 2019, over 950 million users preferred this type of payment. In 2024, the number of mobile payment transactions will be accounted for at 1.31 billion.

Mobile wallets are digital applications that store payment card information on mobile devices. They offer an innovative and more convenient way of making payments. Users can pay for purchases in stores and online with the help of their smartphones.

To create a digital wallet, start with market research and identification of key trends in the industry. After you have a general understanding of how to create a digital wallet, create an app concept, and choose features and payment integrations. After that, you can either start the development yourself or find an app development company that will take on the task.

TOP 8 trip planning apps 2024: Best trip organizers for you

TOP 8 trip planning apps 2024: Best trip organizers for you

How Much Does It Cost To Build An App For your business In 2024

How Much Does It Cost To Build An App For your business In 2024

![How to Create a Workout App: Detailed Guide [Business & Tech]](png/63f7286077982_how%20to%20create%20a%20workout%20app.png) How to Create a Workout App: Detailed Guide [Business & Tech]

How to Create a Workout App: Detailed Guide [Business & Tech]